It's inflation season again, and things are getting hot.

It seems the entire basket of world currencies are facing tremendous devaluations - I just read that the Netherlands is at 17%! The US is around 8.2%, the UK at over 10%, and who knows what the hell is going on in China.

(PS, this post is NOT FINANCIAL ADVICE. If you want trading or investment advice, rather go look for a qualified, credential financial advisor to help you make smart choices. I'm just an idiot with a blog. This post is merely an exploration of my own thoughts, that I'm sharing with you for entertainment purposes only.)

Our money is literally evaporating in front of our eyes, and it's a scary feeling. So , of course, one might be wondering what would be the best vehicle would be to store our hard-earned cash in.

This post is my exploration of possible solutions.

Where would be a good place to store wealth? What are the most common recommendations? What are the trade-offs?

What is inflation?

This post will not be a comprehensive analysis on inflation. There are lots of more qualified websites and YouTube videos that can explain it way better than me.

I'll just give you my 5 second version.

Inflation is the tendency for your money to be worth less this year than it was last. Or, the tendency of things getting more expensive with each passing year.

In other words, $100 could buy a lot more of the exact same candy bars 10 years ago than it could today.

There are many, many reasons behind why this happening, and it all gets very complicated. It is, frankly, way beyond our control anyway, so let's just skip to the part where we try and figure out how to deal it.

What do we want to do with our cash?

Well the best thing we could do with our money is to not keep it in cash. Cash is crap. Keeping cash is like storing your wealth in sand castles.

Cash is worth less with each passing month and transferring the "value" of your cash into something else that will rot away slower is the primary goal.

So, we want to take our cash and transform it into something less likely to crumble away.

Transform it into what? Is gold a good store of value? Crypto? Property/real estate? Shares? Art? NFTs?(no)

The fancy way of phrasing this conundrum is to ask "what are the trade-offs of not keeping our savings in cash, but in 'XYZ' instead?".

Of course, comparing trade-offs are useless without knowing which outcomes are more desirable than others. So we need to determine our desired outcomes(goals) for storing the value of our cash.

Right. So. To determine our goals, I reckon we need to consider;

- the time period of consideration(when does the success/failure of the goal need to be apparent)

- potential devaluation(or ideally growth) of the value in this period, compared to keeping cash

- liquidity(how easy & fast it is to transform the investment back into cash)

- Risk of the alternative to suddenly do worse than cash

Since the dollar is currently the reserve currency of the world, let's take that as our idea of cash.

The period of consideration can be tricky to nail down, dependent on your age or circumstances, so I will opt to simplify things and just set it to 5 years.

5 years, IMO, is long enough to average out the short-term gyrations caused by the news cycle, but also long enough to take into consideration the likelihood of needing to turn our investment back into actually cash money for spending.

In other words, we're not considering retirement investments here.

Our liquidity requirement makes it easy for us to exclude things like real estate or art right off the bat, which would be impossible to quickly convert back into cash.

Alternatives to cash

So what are reasonable alternatives to holding cash? Let's look at some of the most commonly recommended options.

US Treasury bills(bonds)

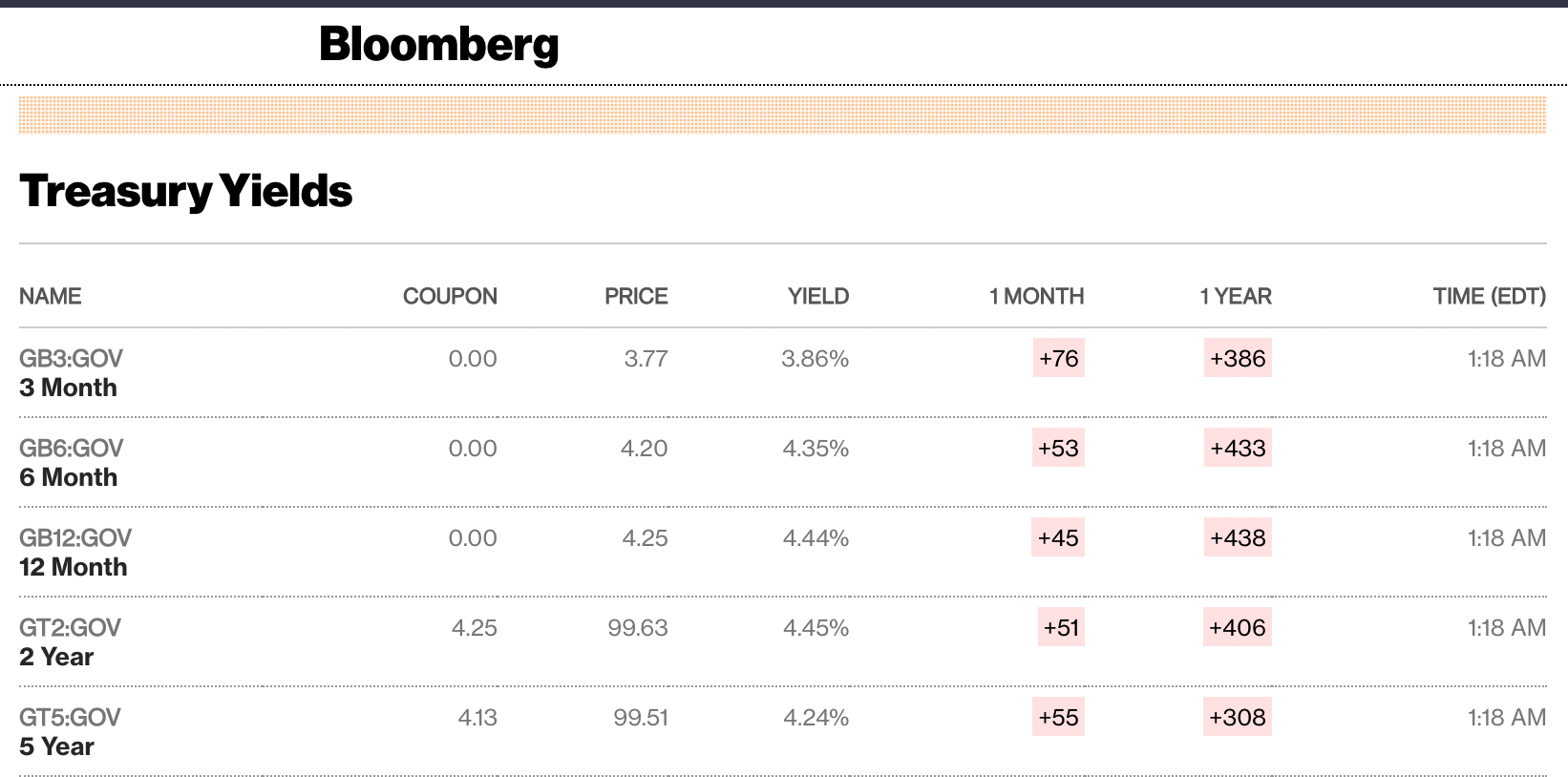

The most common answer to our question is to just buy US treasury bonds. This is a favourite for nation states and large institutional investors, since they are so safe and low risk.

But that's not necessarily a good idea, in my opinion, since the returns are actually half of the US inflation rate! You'll just be burning value slower.

There are some international bonds that offer better returns but they are, of course, a lot riskier. Especially those that offer a good enough yield to cancel out inflation. They are riskier because the risk of the bond payers defaulting is a lot higher.

TIPS

TIPs are Treasury Inflation Protected Securities. They are essentially bonds with principle returns continually adjusted to protect the holder from expected inflation. Your cashflow yield will stay the same, but your payout value will be adjusted for expected inflation.

This sounds pretty good! It's like having the low risk of US government backed bonds, but with some inflation adjustment slapped in there too!

It's not quite that simple though. There are some catches.

- You will be taxed on any upward adjusted principle. And the inflation adjustment(CPI-NSA) is based on a figure other than the one you hear about in the news. The difference is a bit tricky, but essentially the inflation adjustment will be quite a lot less than what you'd expect.

- There can be a months' long delay in value adjustments. But over 5 years, it's not really a biggie.

- The higher inflation gets, the more likely it becomes that interest rates will rise too. Rising interest rates may very likely reduce the longterm principle for instruments like bonds and TIPs. But this is only really a big deal if you need to sell well before maturity.

- TIPs trade less than bonds. If you need to sell in a hurry, this could be something that causes a bit of pain in the form of delays.

- TIPs are based on expected inflation only. If real inflation is more than expected, they can definitely save you some value erosion. But if inflation is not higher than expected, the return would mostly be the same(or sometimes even lower) than regular bonds.

In short, TIPS can help cover you against faster-than-anticipated inflation rises. But TIPS won't protect against inflation that’s just high, but entirely anticipated. We need to decide for ourselves if the market is currently under estimating expected future inflation.

To me, TIPs look like a good solution to store cash over the next 5 years. They are extremely low risk, with a little bit of inflation protection baked in. Currently, I'd choose these over regular bonds, since I think inflation will likely increase more than expected in the coming years.

Gold

The other common recommended inflation hedge is gold, a favourite of the particularly paranoid. Let's look at the return of gold over the last 5 years(courtesy of Macrotrends).

That averages out to a return of 5.70% over five years. That's just marginally better than bonds. But a hell of a lot riskier, since there's no guaranteed return and the variation per year(volatility) is wild.

The past is also no indication of future performance, when it come to something like gold. You see, the problem with gold is that its value is driven entirely by speculative demand only. There's no actual value generation that comes from holding gold that can give us somewhat of an idea as to how much it might be needed in the future.

It just exists, and people might want more or less of it in the future. Unlike some other commodities, like fiat currency or oil.

Oil or fiat currency can at least be used to facilitate the production or execution of some other value-generating activity(cash for trade and oil for energy). This allows us to make a better guess as to how much they might be needed in the future.

Gold values are based purely on speculation, only on its expected ability to store value, and what other people might be willing to pay for it. In other words, 100% pure unadulterated thumb-sucking. This, of course, makes its value extremely unpredictable.

I'd skip this one too - too much of a gamble.

Crypto

Crypto had some crazy returns. It looks super promising looking at its performance over the last 10 years. But on further thought, it might have the same problem that gold has.

It generates no value to base investment decisions of beyond just pure demand. It only has value because people currently want it, not because it actually generates value. Especially Bitcoin.

Ethereum, and other more smart blockchains, are a little bit more complex.

Because they are programmable, they're starting to offer possibilities somewhat similar to fiat currency based instruments, in the form of DEFI smart contracts. You can, essentially, rent out crypto for a return. But man, are they volatile.

True, smart contracts are starting to move crypto somewhat into the direction of being able to generate future value. But in my opinion, they're not there yet in a reliable, predictable way. However, watch this space.

Crypto is just too risky and volatile, in my option. It's the wild-west right now. And governments don't like them one bit. The jury is still out on how safe crypto will be over the medium to long-term, so I'd rather wait a bit.

Don't get me wrong, it's a growing and exciting investment tool, but it's not ideal for reliably preserving cash value at this stage.

Index Funds

Another alternative is to convert our cash into stocks. But not individual stocks, which can be unpredictable. Rather, a diversified basket of stocks in the form of products called index funds.

Index funds are financial products holding the 10 n amount of best performing stocks in a particular market. The ever revolving cream of the crop, so to speak.

Why might index funds be good for preserving cash value? Because index funds do to 4 useful things;

- They average out returns of top performing stocks in a market to approximate the average return of that entire market. This reduces risk.

- They spare us from having to actively manage our portfolios. You buy it and just leave it alone until you need it, like a savings account.

- They save us on trading costs because of their low expense ratios. IOW, they're cheap.

- They are very liquid, ie, they can be converted back into cash in a couple of days at most.

You get lots of different index funds tracking lots of different markets, but for our purposes(beating general inflation), the index fund of choice would be one closest representing the entire US market economy.

The most commonly suggested one of these would be the Vanguard Total Stock Market Index Admiral Shares (VTSAX). Another option would be some fund that tracts the S&P500.

The VTSAX 5 year average is 8.83%, which is just a smidgen above inflation. Nice.

Now, obviously, the return on stocks are still more demand-driven than something like bonds, and are thus more risky.

But, the fact that it averages out the risk across the entire stock market makes it a lot less risky than gold or crypto(or holding pure cash).

Conclusion

From the above option, I reckon the best place to keep your cash save over 5 years would currently either be TIPs or index funds.

TIPS would be the least risky, while index funds would like offer the most protection and be more liquid.